There is a three part test to find out if you are part of Generation Fucked. Try it now.

-

Have you given yourself whiplash trying to catch a glimpse of the bottom rung of the property ladder as it’s being pulled up fast above your head?

-

Have you put off having children for so long that you’re worried you’ll be mistaken for gramps when you drop them off at school?

-

Have you given up on ever really having any money?

The results are in…

If you answered yes to any of the questions, then congratulations. You are part of Generation Fucked. And you are amongst friends.

It’s hard to know exactly where Generation Fucked begins and ends. It incorporates part of Generation X (my generation) and most of Generation Y (Millennials).

It includes everyone who marvels at the standard of living and accumulation of assets that their parents were able to achieve on ‘normal’ jobs.

It includes everyone who bought into the great university rip off and racked up tens of thousands in fees only to find that no-one gave a shit about their Ancient History degree.

It includes all of you who have turned interning into a three year job application (still hopeful…?!)

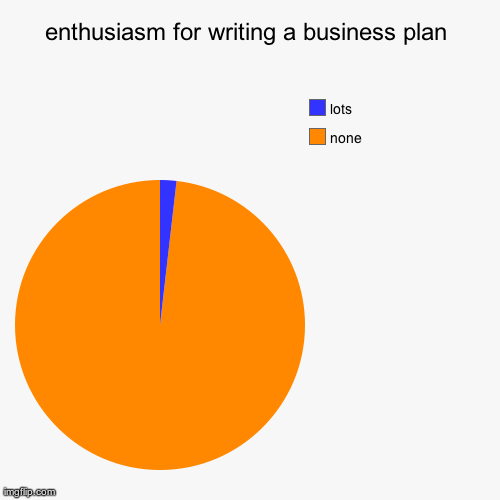

It includes everyone who is working on a start-up in the hope of creating a steady job. Unicorn rodeo rider?

The number of under-35s starting businesses has risen by more than 70pc since 2006

It definitely includes you if you spend more than 40% of your take home wage on rent. Or if you’re one of the 25% who still live at home (even just part-time to take the edge off).

What does it mean to be part of Generation Fucked?

In researching our new business, Lifetise, we’ve spoken to hundreds of people in their 20s and 30s about their lives, their hopes, their fears and their finances.

As you would expect, we heard many different stories, some good, some bad. At times we felt like therapists – I’m sure we know things about people’s financial situations that they haven’t shared with their partners.

What was surprising was that there was a distinct lack of whinging. Everyone we spoke to seemed pretty accepting of their lot. Whilst the newspapers gleefully explain just how much worse Generation Fucked has it than previous generations, our survey showed that all of us poor little mites are just getting on with it.

We don’t need to be told that we are significantly less well off than the generation before us. We have eyes. We can see it. We perhaps hadn’t calculated that we were 21% less well off as at the same marker – but we definitely know we’re falling behind.

What’s clear from our research is that there’s no blueprint for how we should live our lives. The goalposts that we were brought up with have moved; or disappeared. We look at the difference between what we’ve got and what we expected to have and we don’t know if it’s ok.

So we delay a lot of the major life decisions and pretend that we don’t mind. We invest more time in our work because we feel we have more control that way and we convince ourselves that freelancing = freedom, whilst craving a stable monthly salary. Some of us try to save money, some of us can’t, some of us play the Euromillions and curse every time it’s won by someone over the age of 50.

There are 4.6 million freelancers in the UK – a 40 year high

We laugh at the quaintness of a job for life, as we build patchwork (portfolio) careers where hustle, following, and self-promotion count for more than ability. Us 30-somethings twitch at the seeming overwhelming confidence of the 20-somethings, forgetting that their role models are worth $200 million at age 25 and this is where they set their standards.

We over-rely on exclamation marks and emojis – keeping everything pepped up and positive. We generally believe in a sharing economy, but we can’t help but wonder whether it’s a race to the bottom for all but the paymasters. We denounce the 1%ers who made their money from flogging their countries’ natural resources, but some of us will find ourselves part of the new 1% that makes its money from flogging its peers.

We are the most liberal generations ever, but fewer of us drink, smoke, get knocked up early or take drugs. I guess for Millennials, when there’s so much uncertainty around what the future holds, it’s better to be sober and keep your wits about you.

Meanwhile, the over 65s are drinking themselves into a stupor…